It’s an iconic scene, playing out in many movies from Trading Places and Wall Street to A Good Year (below).

Wily traders manipulate the commodity markets by placing a sudden flood of “Sell” orders. The index plunges, panicked traders curse their luck and follow suit. At the bottom, the traders buy it all back on the cheap, catching their rivals out and reaping tens of millions of dollars.

In the real world, regulators claim that speculators don’t drive markets. Supply and demand are the primary determinants of prices, moving in response to spikes in consumption or kinks in production. Short-term volatility can generally be traced to secondary factors, including weather, government policies, transport risks, the global economy, and prevailing sentiment.

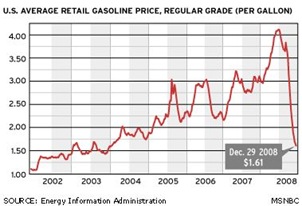

But recent swings in oil prices just seem to defy academic logic:

The microeconomic drivers behind these recent price movements aren’t very evident:

So, is the heavy hand of wily traders behind the oil-price spike?

Time Magazine argues that hedging, rather than speculation, is at fault. Refiner SemGroup overinvested in oil futures, amassing an 11% position by last summer. When forced to liquidate it’s holdings, it stimulated a drop in prices just as markets were debating whether oil had reached their peak. This, in turn, prompted a wider dash for liquidity, leading to further price declines just as the world financial crisis started putting pressure on global markets:

The price of oil began to fall, and speculators had to put up more money for margin, but their other investments were simultaneously declining (due to the collapse of credit and equity markets). Thus, they were forced to close out their long positions and sell oil. As everything spun out of control, everyone wanted out: a full liquidation. Even diversified investors tend to hold long positions in commodities as inflation hedges. Losses in stocks forced these long speculators to liquidate their positions in all commodities.

One thing that I didn’t realize is that the price of oil reported in the news is not actually the raw material price of the commodity. It is, instead, the futures price. The current price of $37.71 / bbl is really the asking price for oil that will be delivered in February 2009. Further, the volume of oil contracts being traded to set this price are a small fraction of the total volume of oil bought and sold on the world’s markets.

Two Stanford students have recently argued that these two characteristics may combine to make oil prices vulnerable to manipulation. An investment of less than 10 billion dollars could enable a speculator acquire a position in the limited futures market that effectively drives prices throughout the larger world market, and then downstream into gasoline and heating oil prices.

They propose that limiting the size of positions or revealing the identities of large stakeholders would close the flaw.

It’s an interesting theory, and suggests how far market structures and forces have diverged from our simple cinematic understanding of them. It’s likely that our system is riddled with similarly subtle, systemic flaws that will need to be corrected if a recurrence of our current financial crisis is to be prevented.

Some feel that the whole collapse was engineered to precipitate a consolidation and reorganization of markets. But I think that our actions have simply grown beyond our understanding. The ad hoc financial networks that developed over the past two decades harbor many hidden correlations and vulnerabilities that are not captured in classical models of discrete and transparent markets.

We now have abundant data to help illuminate the previously hidden factors and relationships that drive pricing and valuation. We need to set better minds and models to understand the roots of our market failures if we are going to formulate effective policy actions and regulatory solutions.

It’s not going to be enough to send Russell Crowe to prison for market manipulation: we need to, in effect, better fence the playfield against excess, and assure rapid access to information and transparency to actions.