Out with the old…

…and ready for some ‘new.

Wishing you a 2009 to (happily) remember !

Art by Mark Kostabi

Random Walks in the Low Countries

Reflections and observations on the expatriate experience from an American scientist living and working in the Netherlands.

by Dave Hampton

Out with the old…

…and ready for some ‘new.

Wishing you a 2009 to (happily) remember !

Art by Mark Kostabi

by Dave Hampton

As I talk about my future career alternatives with friends and colleagues, the potential for a “glass ceiling” emerges repeatedly. Am I aspiring to positions beyond my reach? Will I be considered for positions where I’m qualified?

As I talk about my future career alternatives with friends and colleagues, the potential for a “glass ceiling” emerges repeatedly. Am I aspiring to positions beyond my reach? Will I be considered for positions where I’m qualified?

I’ve always been a positivist: believing that the ceiling is just the natural upper bound of a career’s trajectory, the limit of advancement defined by talent, time, and circumstance, unaided by fortune or ambition.

But it’s been an interesting conversation. Some disagree with me, holding that there is an arbitrary limit for anyone that results from simple discrimination trumping hard work and merit.

What form might the glass ceiling take?

Princeton describes it as “an attitudinal or organizational bias that prevents women from advancing to leadership positions”. To me, this seems archaic: I have worked comfortably with, and for, women throughout my career. In my experience, people earn respect and advancement based on their competency, skills, and congeniality. Still, it is very real to women I talk with, and it may be that I’ve missed it by working primarily in research and project teams in my career.

Others have generalized the term to include “situations where the advancement of a qualified person within the hierarchy of an organization is stopped at a lower level because of any form of discrimination”. This one hits closer to home, because I can think of any number of highly qualified people who have been shuttled into the career ghettos. Their ceiling lies at the public boundary: at the top of the hierarchy, leaders are chosen to reinforce the image that the company wants to project to customers, the media, and investors. The ability to communicate clearly and to inspire confidence may be the only necessary qualities. “House” need not apply.

Others have generalized the term to include “situations where the advancement of a qualified person within the hierarchy of an organization is stopped at a lower level because of any form of discrimination”. This one hits closer to home, because I can think of any number of highly qualified people who have been shuttled into the career ghettos. Their ceiling lies at the public boundary: at the top of the hierarchy, leaders are chosen to reinforce the image that the company wants to project to customers, the media, and investors. The ability to communicate clearly and to inspire confidence may be the only necessary qualities. “House” need not apply.

Intriguingly, I also found this definition: “The glass ceiling is the seemingly unattainable 1st page ranking in a search engine, particularly for very competitive keywords. Sites and pages remain on the 1st page and are hard to displace because they are given really high rankings and have extremely high link popularity.” Extrapolated, it suggests that those above the glass ceiling form a self-reinforcing club: those at the top accumulate perceptions and credibility that keep them at the top. I suspect that there is a lot of truth in this.

All of these definition have the common quality that a person’s potential for advancement may be limited by bias and circumstance, rather than by drive and accomplishment. It’s not the way I treat others nor how I think about my own opportunities. But, as I seek my next position, I sometimes find myself wondering whether perceptions of age or disability, personality or nationality, might, in fact, limit my aspirations.

And, more to the point, how to recognize and counter it.

Photo credit: Judith Orr

by Dave Hampton

Maybe Mother Nature needed to be appeased, satisfied when Governor Gregoire declared a snow emergency. Or maybe the Fates demanded acknowledgement from thoroughly snarled Christmas travel and shopping throughout the Northwest. Or, perhaps, it was just a last jab from the dismal spirit behind 2008.

Whatever the reason, the temperatures finally began to rise today and skies began to drizzle familiar rain. The snow softened; cars literally sank into the snowpack covering the roads. I could drive along the streets hands-free, the wheels steering themselves along the deep ruts. The gullies filled with icy slurry on the hills, and cars began to accumulate along the side streets, unable to climb home.

The plows finally appeared this morning, and the roads have become passable enough that mail (absent for days), package delivery (absent a week), and garbage collection (absent since the 11th) can resume. Predictions are that life will return towards normal by next weekend, just in time for my departure for the Netherlands.

The plows finally appeared this morning, and the roads have become passable enough that mail (absent for days), package delivery (absent a week), and garbage collection (absent since the 11th) can resume. Predictions are that life will return towards normal by next weekend, just in time for my departure for the Netherlands.

Despite it all, this has been one of the least stressful holiday periods in recent memory. The cards got out, the presents were shipped, the decorating and baking got done as always. But the usual sense of being pressed and rushed was almost entirely absent.

I’m not sure why. It’s the first Christmas where the children haven’t all been here, but I can’t imagine that would have an impact. Maybe everyone got philosophical about only expecting things to be done when, and if, they could be done. But it’s been a nice change.

by Dave Hampton

It’s an iconic scene, playing out in many movies from Trading Places and Wall Street to A Good Year (below).

Wily traders manipulate the commodity markets by placing a sudden flood of “Sell” orders. The index plunges, panicked traders curse their luck and follow suit. At the bottom, the traders buy it all back on the cheap, catching their rivals out and reaping tens of millions of dollars.

In the real world, regulators claim that speculators don’t drive markets. Supply and demand are the primary determinants of prices, moving in response to spikes in consumption or kinks in production. Short-term volatility can generally be traced to secondary factors, including weather, government policies, transport risks, the global economy, and prevailing sentiment.

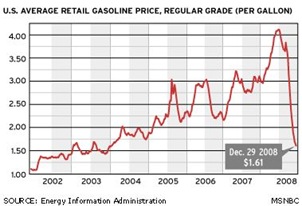

But recent swings in oil prices just seem to defy academic logic:

The microeconomic drivers behind these recent price movements aren’t very evident:

So, is the heavy hand of wily traders behind the oil-price spike?

Time Magazine argues that hedging, rather than speculation, is at fault. Refiner SemGroup overinvested in oil futures, amassing an 11% position by last summer. When forced to liquidate it’s holdings, it stimulated a drop in prices just as markets were debating whether oil had reached their peak. This, in turn, prompted a wider dash for liquidity, leading to further price declines just as the world financial crisis started putting pressure on global markets:

The price of oil began to fall, and speculators had to put up more money for margin, but their other investments were simultaneously declining (due to the collapse of credit and equity markets). Thus, they were forced to close out their long positions and sell oil. As everything spun out of control, everyone wanted out: a full liquidation. Even diversified investors tend to hold long positions in commodities as inflation hedges. Losses in stocks forced these long speculators to liquidate their positions in all commodities.

One thing that I didn’t realize is that the price of oil reported in the news is not actually the raw material price of the commodity. It is, instead, the futures price. The current price of $37.71 / bbl is really the asking price for oil that will be delivered in February 2009. Further, the volume of oil contracts being traded to set this price are a small fraction of the total volume of oil bought and sold on the world’s markets.

Two Stanford students have recently argued that these two characteristics may combine to make oil prices vulnerable to manipulation. An investment of less than 10 billion dollars could enable a speculator acquire a position in the limited futures market that effectively drives prices throughout the larger world market, and then downstream into gasoline and heating oil prices.

They propose that limiting the size of positions or revealing the identities of large stakeholders would close the flaw.

It’s an interesting theory, and suggests how far market structures and forces have diverged from our simple cinematic understanding of them. It’s likely that our system is riddled with similarly subtle, systemic flaws that will need to be corrected if a recurrence of our current financial crisis is to be prevented.

Some feel that the whole collapse was engineered to precipitate a consolidation and reorganization of markets. But I think that our actions have simply grown beyond our understanding. The ad hoc financial networks that developed over the past two decades harbor many hidden correlations and vulnerabilities that are not captured in classical models of discrete and transparent markets.

We now have abundant data to help illuminate the previously hidden factors and relationships that drive pricing and valuation. We need to set better minds and models to understand the roots of our market failures if we are going to formulate effective policy actions and regulatory solutions.

It’s not going to be enough to send Russell Crowe to prison for market manipulation: we need to, in effect, better fence the playfield against excess, and assure rapid access to information and transparency to actions.

by Dave Hampton

Everyone jumped when there were a series of thumps and thuds next to the house this morning. One of the rhododendron trees had fallen over under the weight of the snow, now sprawled across the rear door.

Everyone jumped when there were a series of thumps and thuds next to the house this morning. One of the rhododendron trees had fallen over under the weight of the snow, now sprawled across the rear door.

This kicks off the quintessential Pacific Northwest winter task, knocking snow off the landscaping. The magnolia tree and the rhododendron bushes suffer more than the evergreens. The taller trees tend to just droop, finally allowing the snow to slide off. The bushes wither in the cold, but try to stay erect. Eventually the branches break off.

The only solution is to take a broom and wade into the snow, whacking up from the bottom or out from the trunk. Unfortunately, there’s no way to relieve the upper branches except to get in and shake the tree, dropping about a foot of snow down on myself.

And, of course, by morning, it all has to be done again…

And, of course, by morning, it all has to be done again…

The governor has declared a winter emergency as we break the snow records here in the lowlands…everyone is starting to look a bit weary from the weather. My favorite was the dilapidated state of the tent at the local Christmas Tree seller.

For myself, I’ve broken out the eggnog and the rum and have settled in for a warm and comfortable Christmas Eve. Best wishes for a warm and happy holiday to everyone!

by Dave Hampton

Holiday’s are always a time for preparing favorite dishes and festive treats. I have several recipes that get dusted off at this time of year, and I spent most of the day with the daughter making cookies and cranberries. The cookies are simply family favorites: the cranberry recipe comes form an out-of-print HP microwave cookbook, but has always been ‘can’t miss’ for jelling into relish at Thanksgiving and Christmas.

I managed to fill the kitchen with smoke making Dutch Speculaas cookies, baking at 375 instead of 350 <sigh>. Part of the problem is that I mistook the Speculaas dough for the Molasses dough, making balls and rolling them in sugar. In the end, I had golf-ball sized round windmill cookies. I dipped them in frosting and turned them into festive little spice buttons…people are talking about making them a tradition now. I think I’m just losing my touch in the kitchen…’glad I got a daughter to help!

Rugelach

Cut butter into flour using two knives as if making a pie crust. In a separate bowl, beat egg yolk and sour cream well, then add to flour mixture. Mix until blended. Divide dough into three parts. Cover with plastic and refrigerate at least 3 hours.

Prepare filling by combining sugar, cinnamon, and (optional ) walnuts. Pre-heat oven to 375 deg F.

Working with one portion at a time, roll dough into circle 1/8” thick. Brush each circle lightly with melted butter and spread one third of the filling on each. Cut each circle into 16 wedges, like a pizza. Starting from the large end of each wedge, roll up toward point, jelly-roll fashion. Place cookies on ungreased cookie sheets and bake 15 minutes or until lightly browned. Cool on racks and store in covered tins.

Yield: About 4 dozen.

Cranberry Sauce

In a deep 2-qt casserole dish, combine sugar, water, and liqueur. Microwave, uncovered, at full power for 4 to 5 minutes, until boiling, stirring once or twice to dissolve sugar. Syrup should be clear. Stir in cranberries and cover loosely with waxed paper. Microwave at full power for 5 minutes or until the skins on the cranberries pop, stirring once. Uncover and microwave at 30% for 15 minutes or until thickened to the desired consistency, stirring once. Cover and refrigerate.

Yield: 2 cups

Molasses Cookies

¼ cup molasses

Melt shortening in a 3-4 quart bowl. Add sugar, molasses, and egg, beat well. Sift together the dry ingredients and add to the liquid. Mix well, chill for 1 ½ hour. Roll into 1” balls, and roll each in sugar. Pre-heat over to 375 degrees F. Bake on a greased cookie sheet, 2” apart (do not flatten the dough) for 5-6 minutes.