What does Texas Hold ‘em teach about entrepreneurship?

What does Texas Hold ‘em teach about entrepreneurship?

Hang in: this will be three definitions, one simple unifying rule, and a big epiphany.

1) Texas Hold ‘em is a variant of Poker, a card game, in which two cards are dealt face-down to each player and five shared cards are dealt face-up in the middle of the table. The winner is the one who makes the best 7-card poker hand using their two hidden cards. It’s a beloved pastime among Wall Street and business strategy folks.

2) Players can compute the probability of winning in a specific situation by calculating Hand Odds. Suppose, for example, that you are dealt the 6 and 7 of spades and that the four shared cards dealt so far have two more spades showing. What is the chance of you getting a flush when the remaining card is dealt?

2) Players can compute the probability of winning in a specific situation by calculating Hand Odds. Suppose, for example, that you are dealt the 6 and 7 of spades and that the four shared cards dealt so far have two more spades showing. What is the chance of you getting a flush when the remaining card is dealt?

There are 52 cards in the deck, 13 of each suit. So, there are 52-6=46 cards unseen, and 13-4=9 spades remaining. 9/46 gives just under a 20% chance that you will complete your flush: you will get your card one time in five.

Do you bet on that?

3) Before you decide, look at the pot. What is the size of the pot (say, $60 on the table) vs. the amount that it costs to to have a chance of winning it (a $10 bet)? The ratio is the Pot Odds: in this case 60/10=6. So, if you won only one time in six you would make money.

There are, of course, tables for this:

Now, would you bet? If you have a one in five chance of getting your card, and only need to win once in every six hands, yes.

The (over)simple, unifying rule:

When hand odds beat pot odds, you bet.

The epiphany: Portfolio Entrepreneurship

80% of medical device ideas go bust. So the odds of any single venture succeeding, the hand odds for the startup if you will, are one in five.

But the most you can lose is the money you invest, and the upside return can be tremendous. So as long as you can stay in the game, and the returns (pot odds) are greater than five times your investment, you will make money in the long run.

I’ve thought a lot about this in the last couple of weeks, since hearing about the general idea on Radiolab. It explains why 10x or 30x returns are mandatory or investors, and how they can tolerate the majority of businesses failing. It also addresses a question that I’ve had for some time: is it better to be a serial entrepreneur, with only one business at a time, or a portfolio entrepreneur, running more than one?

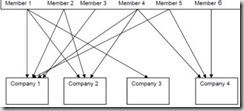

There is no advantage either way (the odds are the same in either case) if there is independence among the businesses.

But if a prior failure diminishes the chance of finding funding, or confidence in running the second business, then the interaction makes the second more difficult for serial entrepreneurs.

It almost makes more sense to take on several independent businesses at the same time, running them as a portfolio, to get maximum chance of success in the shortest time.

“Non-interacting” is still a key word: there are only so many hours in the day and limited total energy that any one entrepreneur can put in. Many investors argue that anything less than total focus and commitment greatly diminishes the chances of success.

But with proper partitioning and prioritizing, good partners and delegation, and adequate funding, I think that there are advantages to portfolio entrepreneurship. The pot odds increase the overall chances for success, independent to hand odds. And the accelerated learning, synergistic ideas, common networks, and shared services can increase the opportunity and efficiency of the whole.

And this isn’t abstract. A recent study concludes that portfolio entrepreneurs have more diverse experiences, and more resources than serial or novice entrepreneurs. On average, portfolio entrepreneurs appear to offer more attractive growth prospects than other entrepreneurs.

Investors routinely spread themselves to decrease risk.

Entrepreneurs can spread themselves to improve the odds.